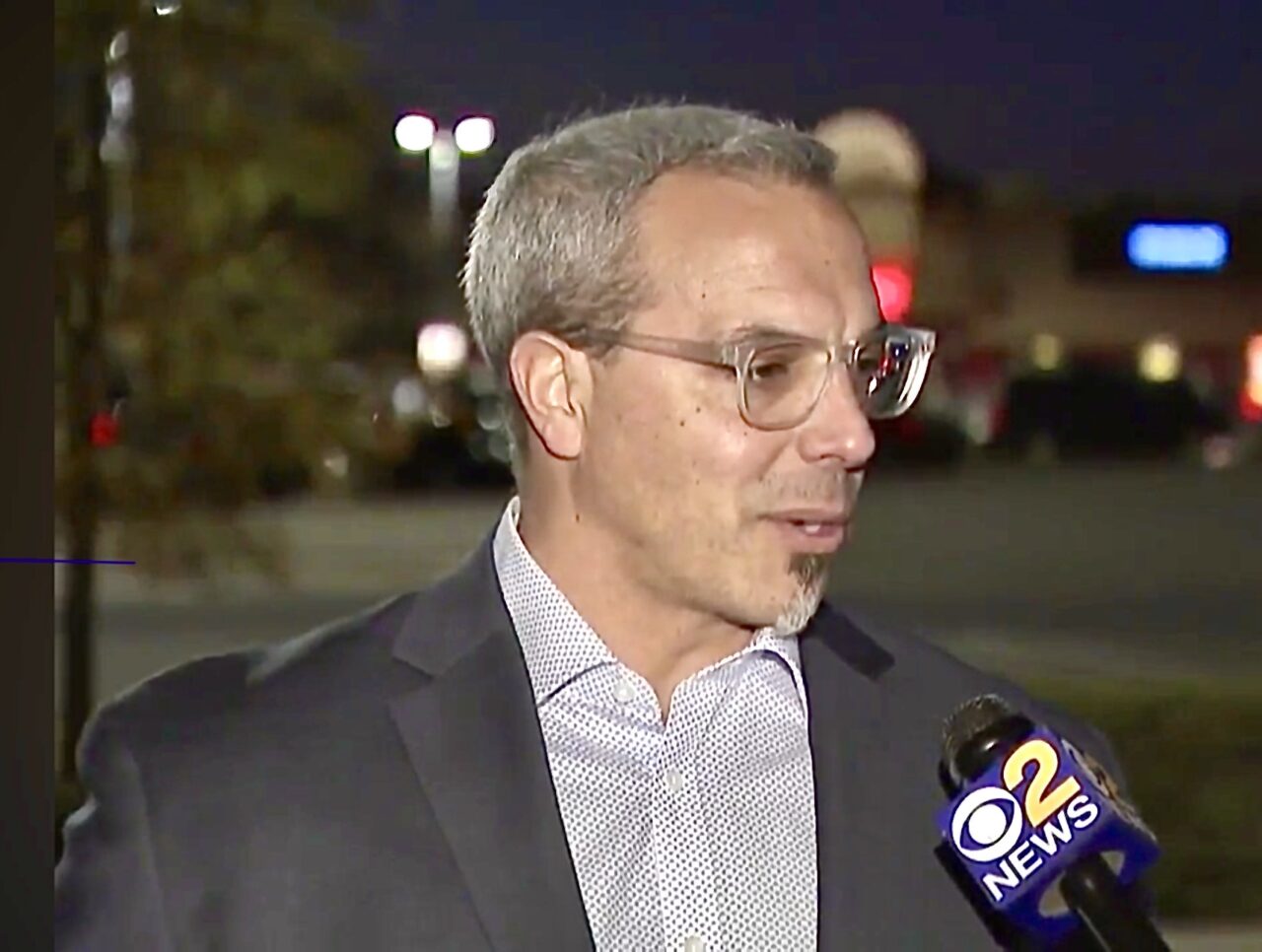

The holiday season glimmers with golden gift wrap, festive lights, and promises of finding that perfect present for a loved one. Whether it’s jewelry that catches the eye or the thrill of scoring a great deal, holiday shopping is a cherished tradition for many Americans. However, as consumer credit expert Erik Sturken warns, this festive spirit can come with a hefty price: skyrocketing debt and sinking credit scores.

“Too many people don’t plan ahead,” Sturken says. By the time January arrives, his office is bustling with clients struggling to manage the financial aftermath of holiday spending. One of the most common mistakes? “They don’t buy with cash,” he explains. Instead, shoppers rely heavily on credit cards, often pushing their utilization rates to the limit—a factor that accounts for 30% of a person’s credit score. “If you max out your card, your score can drop by as much as 30%,” Sturken cautions. His advice is simple yet powerful: in most cases, cash is king. Spending within your means keeps financial stress at bay.

When it comes to store credit cards that offer tempting discounts, Sturken offers a word of caution. While the allure of an immediate discount may be hard to resist, it’s a double-edged sword. “If you can’t pay off the balance quickly, those cards typically carry interest rates in the high 20s,” he notes. That ‘50% off’ deal could end up costing you far more than expected if you’re stuck making only minimum payments.

Beyond credit card pitfalls, Sturken advises consumers to be mindful of their shopping habits. Starting too early can lead to overspending over several weeks, while waiting until the last minute may result in impulsive splurges on expensive, unnecessary items. The solution? Borrow a page from Santa’s playbook: make a list. “Write down exactly what you can afford—and stick to it,” Sturken says.

Without a plan, many consumers wake up in January with a harsh realization. “You’re looking at your bank statement thinking, ‘Oh my God, what have I done?’” Sturken says. That post-holiday panic can set off a month of financial stress and scrambling to recover.

The bottom line: thoughtful planning and disciplined spending can keep the holiday season merry without turning the new year into a financial nightmare. As you hunt for that perfect gift, remember: deals come and go, but financial health is priceless.